The Mobile Ad Monetization Newsletter #21

The $250 Million Question: Why Playrix Avoids In-Game Ads

Life is full of mysteries, but few are as financially puzzling to me as this one. Why does Playrix, the mobile gaming giant behind Gardenscapes, Township, and Homescapes, not monetize with in-game ads? Playrix’s choice to conservatively leave as much as a quarter of a billion dollars per year on the table is very unusual and worth diving into.

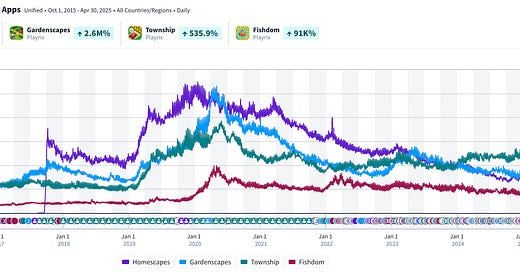

Let’s take a look at Playrix’s impressive game portfolio in Sensor Tower. In the last 30 days, Playrix has generated $125 million in IAPs and 15 million downloads. That revenue primarily comes from Township, Gardenscapes, Fishdom, and Homescapes. Playrix’s four flagship titles see a daily active user base of around 15-16 million players.

Releasing mobile hits is very difficult. What’s even more difficult is releasing games that rival the success of any of Playrix’s flagship titles. Despite the lack of new breakout hits, Manor Matters, for example, brings in just $2.6 million annually. Playrix has continued to monetize its massive existing audience exceptionally well.

Oxana Fomia pointed out eloquently in a recent post that Fishdom has introduced long-term meta-events that run for nearly a month, which have led to retention and revenue gains. Looking at the portfolio, you can see that DAU has decreased, but revenue is stable.

One possible reason for Playrix’s hesitation could be its focus on long-term player LTV and retention. Even if selectively shown, in—game ads can introduce friction, especially for high-value spenders. The team may believe that maintaining a pristine, IAP-only experience keeps churn low and whale spending high, particularly in its top revenue-generating cohorts. The Dream Games portfolio of games is a shining example of achieving scale without in-game ads.

But opposite the Dream Games argument, there’s Candy Crush. King is rumored to generate close to $500 million annually from in-game ads. Candy Crush heavily segments its users and shows Rewarded and even interstitial ads to a subset of users.

Could the argument be made that in match-3, it makes no sense to launch and scale without in-game ads, but only to add them later when the games start to decline?

The answer is always two-sided, but let’s examine the revenue opportunity if Playrix adds in-game ads.

The Revenue Opportunity

Let’s make some assumptions. According to Sensor Tower, in the last 30 days, Playrix’s four main games had nearly 15 million daily active users, 1.5 million of whom were in the USA. About 8.2 million daily users are from the match-3 games, and another 6 million daily active users are on Township. Let’s make a very conservative estimate.

In this example, Playrix would show RV ads to only about 50% of the respective titles' user base, with a subset of users also seeing some interstitial ads. In this particular example, Playrix would generate $210 million per year from in-game ads.

I agree that the above example might be a bit too aggressive. Still, even assuming a conservative average of 2 ad impressions per daily active user (IMP/DAU) across just 55% of the U.S. match-3 audience, Playrix would still generate around $170 million per year from in-game ads. Let’s call that the revenue range.

That brings us to another significant revenue opportunity: mediation and network bonuses. Mobile ad networks and mediation platforms constantly compete for high-quality supply, and they’re willing to pay a premium to secure it. Rewarded video inventory, in particular, is highly valued thanks to its strong margins and conversion rates.

Based on my experience in mobile advertising and benchmarks from similar games, I estimate that Playrix could generate an additional $40–70 million annually through mediation and network deals alone. This would increase our possible revenue range to $210-280 million per year for Playrix to integrate in-game ads.

According to Sensor Tower, Playrix’s four flagship titles have brought in $1.6 billion in IAP revenue over the past 12 months. So maybe, from Playrix’s perspective, adding 13–17.5% more through ads isn’t worth the potential risk to long-term player value. But from the outside, it is one of the clearest ways to unlock scalable revenue.

Don’t agree? Like most things in life, there are no perfect answers. I’d love to hear your take in the comments below.

For More Incredible Insights

Try 2.5 Gamers on YouTube!